Toyota sold 10.8 million vehicles globally in 2024, that's roughly 1,235 cars every hour, around the clock, for an entire year! This staggering figure puts the Japanese giant firmly at the top of the automotive food chain, but the story of today's automotive landscape is far more complex than a simple sales race.

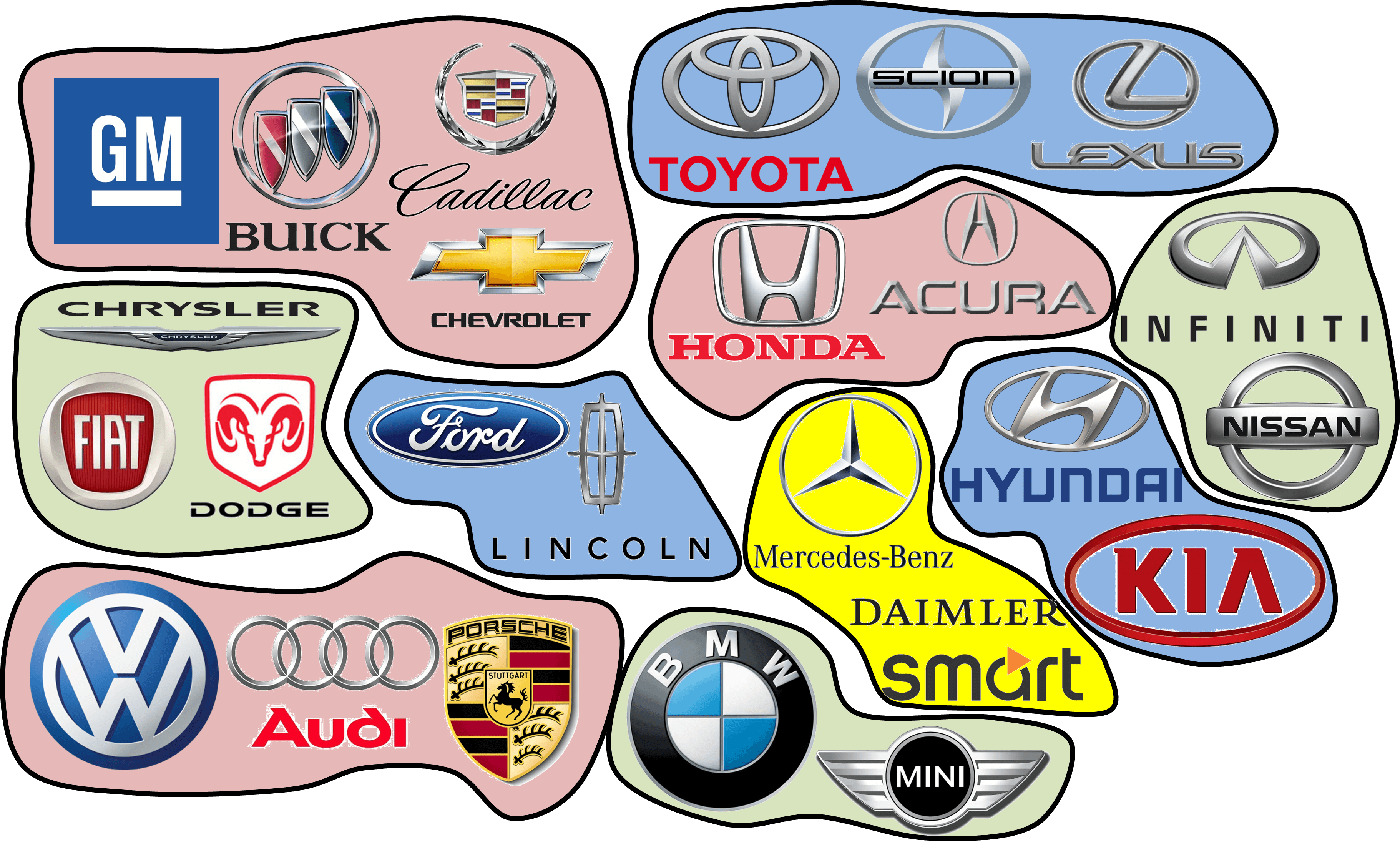

Behind every car badge lies a web of corporate relationships that would make a genealogist dizzy. The automotive industry has transformed into a collection of massive conglomerates, each controlling multiple brands that compete against each other in showrooms while sharing everything from engines to boardrooms. Understanding these automotive empires isn't about memorizing corporate charts, it's about grasping how the cars we drive, love, and sometimes curse are born from these industrial titans.

Toyota Motor Corporation

When mechanics say "It'll run forever," they're usually talking about a Toyota. This isn't just folklore, it's backed by a corporate machine that generated ¥45.1 trillion ($302 billion) in revenue for fiscal 2024, making it the world's most profitable automaker with earnings of $46.41 billion.

Toyota's empire stretches far beyond the Corolla and Camry. The corporation owns Lexus (the luxury division that revolutionized premium car reliability), Hino (commercial trucks), and Daihatsu (compact cars popular in Asia). They also hold significant stakes in Subaru (8.7% ownership) and maintain partnerships that blur traditional competitive lines.

Chairman Akio Toyoda has become the industry's most vocal EV skeptic, famously declaring, "The more EVs we build, the worse carbon dioxide gets." His controversial stance stems from a belief that battery production creates more emissions than hybrid alternatives. "I think EVs will never exceed a 30 percent market share," Toyoda stated, betting Toyota's future on hybrid technology while competitors race toward full electrification.

The numbers support Toyota's cautious approach. The RAV4 claimed the global best selling car crown in 2024 with 1.187 million units, narrowly beating Tesla's Model Y. The Corolla series (including sedan and cross variants) combined for over 1.5 million sales worldwide. These aren't vehicles people buy for status, they're the cars that define practical transportation.

Toyota's future plans center on "carbon neutrality by 2050" rather than pure electrification. They're investing heavily in hydrogen fuel cells, synthetic fuels, and next generation hybrids. As Toyoda puts it, “We believe in providing customers with as many options as possible.”

Volkswagen Group

"Das Auto" isn't a marketing slogan, it's a statement of intent from a group that controls 12 brands spanning every segment from budget to hypercars. With €322.3 billion in revenue for 2024, Volkswagen Group represents the pinnacle of European automotive engineering and complexity.

The VW empire includes household names like Audi (1.67 million sales in 2024), Porsche (135,000 units), SEAT, Škoda, and Bentley. But the real money makers are the crown jewels: Lamborghini and Porsche together account for just 1% of group sales but generate nearly 60% of luxury profits. A single Lamborghini averages €301,000 per car with €83,000 profit per unit, margins that would make tech companies jealous.

CEO Oliver Blume took the helm with a clear message: "Emobility is the future, and we will keep the current pace and, where possible, increase it." Unlike Toyota's hesitation, Volkswagen is charging full speed toward electrification, planning to launch 30 new electric models by 2030.

The group's challenge lies in balancing tradition with transformation. Porsche remains the profit engine, Audi competes directly with BMW and Mercedes, while the Volkswagen brand itself fights for middle class buyers against Toyota and Ford. Škoda has become the value champion, offering German engineering at Czech prices.

Blume faces unique pressures as both Porsche and Volkswagen Group CEO, a dual role that reflects how intertwined these brands have become. "We act with the mindset of a future oriented transformation," he explains, “striving to have a positive impact on nature and society.”

General Motors

“Every Chevy is sold every 8.33 seconds”, that's the pace at which America's largest automaker moves metal. GM reported record 2024 revenue of $187.4 billion, the highest since 2013, proving that rumors of Detroit's demise were greatly exaggerated.

GM's brand portfolio reads like American automotive history: Chevrolet (the volume seller), Cadillac (luxury with attitude), GMC (premium trucks), and Buick (surprisingly popular in China). Each brand targets specific demographics with surgical precision, Chevy for everyone, GMC for contractors who want leather seats, Cadillac for those who refuse German luxury.

CEO Mary Barra has spent her decade long tenure transforming GM into an electric vehicle powerhouse. "2024 is a year of execution," she declared, and the results show. GM's EV sales grew dramatically, with the company expanding Super Cruise (hands free driving) across more Chevrolet models than ever before.

Barra's challenge isn't technical, it's cultural. As she puts it, "We're in an industry that is transforming, we're a company that's transforming." GM is simultaneously the most American of automakers and the most globally ambitious, competing against Tesla in EVs while defending truck territory against Ford and Ram.

The Silverado and Sierra pickups remain GM's cash cows, but the Equinox EV represents the future, affordable electric transportation for middle America. "EVs are fun to drive, instant torque," Barra notes. “I think our EVs have beautiful designs, the right range, the right performance.”

Stellantis

When Fiat Chrysler Automobiles merged with France's PSA Group in 2021, it created Stellantis, a €189 billion revenue giant controlling 14 brands across three continents. The marriage hasn't been smooth.

Former CEO Carlos Tavares, who resigned in December 2024, admitted his approach created problems: "I could've done tons of things differently. At one point there is a leadership issue." His fixation on short-term profits over long-term brand health left Stellantis struggling in key markets, particularly the United States.

The Stellantis portfolio spans from Jeep (the off road icon) and Ram (truck challengers) to European favorites like Peugeot, Citroën, and Opel. Italian passion comes via Alfa Romeo, Maserati, and Fiat. Chrysler continues as a shadow of its former self, while Dodge maintains muscle car heritage.

Jeep remains the crown jewel, but sales declined 10% year over year in early 2025. The Wrangler still defines off-road capability ("It's a Jeep thing, you wouldn't understand"), while the Grand Cherokee competes for suburban driveways against German SUVs.

New CEO Antonio Filosa faces a daunting challenge: "Mediocrity is not worth the trip," he declared, inheriting a company that lost 55% of its stock value under Tavares. The focus shifts from cost cutting to product investment, particularly in electric vehicles where Stellantis lags competitors.

Ford Motor Company

Ford isn't the largest American automaker, but it might be the most American. With $176 billion in revenue for 2024 and the best-selling vehicle in America (the F-Series trucks), Ford represents both tradition and transformation.

The company's structure is deceptively simple: Ford brand (everything from Mustangs to F-150s) and Lincoln (luxury division struggling for relevance). But Ford's complexity lies in its strategic bets, from the Bronco revival to the F-150 Lightning electric truck.

"Made in America" resonates differently at Ford than elsewhere. The F-150visn't a product, it's an institution, serving everyone from construction workers to suburbanites who never tow anything heavier than a boat. The electric Lightningvrepresents Ford's biggest gamble: Can you electrify America's favorite truck without losing its soul?

Ford's challenge is evolution without alienation. The company must satisfy customers who say "Real trucks don't plug in" while meeting emissions regulations and competing against Tesla. The Mustang Mach-E proved Ford could build compelling electric vehicles, but the F-150 Lightning will define the company's electric future.

CEO Jim Farley focuses on "Ford+" strategy, emphasizing connected services and direct customer relationships. Unlike GM's broad EV assault or Toyota's hybrid hedging, Ford picks its electric battles carefully, trucks and performance cars where the Blue Oval has credibility.

Hyundai Motor Group

Hyundai Motor Group's rise from "cheap car" jokes to legitimate luxury competitor represents one of automotive history's greatest transformations. With combined sales of 7.3 million vehicles in 2024, the group trails only Toyota and Volkswagen globally.

The empire includes Hyundai (mainstream brand), Kia (stylish alternative), and Genesis (luxury upstart). Each brand maintains distinct character while sharing platforms and technology, a strategy that maximizes efficiency without sacrificing identity.

Genesis deserves special mention as automotive's biggest surprise. Launched in 2015, the luxury brand competes directly against BMW, Mercedes, and Lexus with stunning designs and generous warranties. "People know quality when they see it," customers often remark, and Genesis sales reflect growing recognition.

Hyundai's secret weapon is design leadership. Chief Creative Officer Luc Donckerwolke brings European sensibilities to Korean efficiency, creating vehicles that look expensive regardless of price. The Sonata, Elantra, and Tucson punch above their weight class visually.

The group's electric offensive centers on dedicated EV platforms rather than adapted gas car architectures. The IONIQ 5 and EV6 showcase what's possible when manufacturers design electric from the ground up, fast charging, innovative interiors, and striking aesthetics that make Tesla look conservative.

The Future of Automotive Empires

These six groups don't just build cars, they shape mobility's future. Toyota bets on hybrid diversity, Volkswagen embraces full electrification, GM rebuilds around EVs and autonomy, Stellantis seeks stability amid chaos, Ford electrifies carefully, and Hyundai surprises everyone with unexpected excellence.

Other Notable Brands

While the automotive world is dominated by massive conglomerates, several influential brands deserve recognition for their unique market positions, technological innovations, or cultural significance. These companies represent different approaches to the automotive business, from pure luxury to electric vehicle disruption to emerging market powerhouses.

BMW Group

BMW Group stands as Germany's most focused luxury automotive empire, controlling three carefully curated brands that rarely compete directly with each other. With €153.2 billion in revenue for 2024 and 2.25 million vehicles delivered globally, BMW represents precision engineering meeting market segmentation.

The group's structure is elegantly simple: BMW handles mainstream luxury (sedans, SUVs, and the iconic 3 Series), MINI captures quirky premium small cars, and Rolls-Royce defines ultra luxury with vehicles averaging over €500,000 each. Each brand maintains distinct identity while sharing advanced technologies and manufacturing expertise.

BMW's 2024 performance tells a story of premium resilience. While net profits fell 37% to €7.68 billion due to subdued Chinese demand, the company maintained its position as the world's leading luxury car manufacturer. The X3 and X5 SUVs drove global sales, while MINI faced challenges with a 17% decline to 244,915 units as the brand transitions to electric only by 2030.

Rolls-Royce deserves special mention as automotive's ultimate luxury statement. Selling just 5,712 vehicles in 2024 (down 5.3%), each car represents months of hand craftsmanship and bespoke customization. As one customer noted, “You don't buy a Rolls-Royce, you commission one.”

The group's electric transformation centers on the iX and i4 models, with 426,594 battery electric vehicles delivered in 2024, a 13.5% increase. CEO Oliver Zipse maintains that "electrification is the future, but customer choice remains paramount," reflecting BMW's balanced approach to the EV transition.

Mercedes-Benz Group

Mercedes-Benz Group reported €145.6 billion in revenue for 2024, positioning itself as BMW's primary German luxury rival. The group's strategy focuses on "luxury above all else" with brands including Mercedes-Benz, Mercedes-AMG, Mercedes-Maybach, and the G-Class.

What sets Mercedes apart is its "Top End" vehicle strategy. These ultra-luxury models, AMG performance cars, Maybach limousines, and G-Class SUVs, represented 14.6% of sales in Q1 2025 but generated disproportionate profits. A Maybach S-Class starts at €180,000, while AMG GT models command €200,000+ with margins exceeding 40%.

The brand's 2024 performance showed resilience despite market challenges. Global sales reached 1.98 million vehicles, with strong performance in Germany, China, and the United States. The GLE and GLC remained best sellers, while the EQS electric sedan established Mercedes' electric luxury credentials.

Mercedes' approach to electrification differs from BMW's diversification. The company commits to "electric-first" luxury, with CEO Ola Källenius declaring, "We will be ready to go all electric by 2030, wherever market conditions allow." The EQS and EQE models showcase what happens when luxury brands design electric vehicles without compromise.

Tesla

Tesla represents automotive's most significant disruption since the assembly line. With $97.7 billion in revenue for 2024 and 1.79 million vehicles delivered globally, Tesla single handedly created the premium electric vehicle market while forcing traditional automakers to accelerate their electric transitions.

The company's product lineup remains deliberately focused: Model 3 (compact sedan), Model Y (crossover), Model S (luxury sedan), Model X (luxury SUV), and the Cybertruck (polarizing pickup). This simplicity enables manufacturing efficiencies that traditional multi-brand competitors struggle to match.

Tesla's 2024 performance reflects both the company's dominance and emerging challenges. The Model Y claimed second place in global vehicle sales with 1.15 million units, narrowly trailing the Toyota RAV4. However, Q2 2025 showed concerning trends with deliveries dropping 14% year over year to 384,000 units, the largest quarterly decline in company history.

CEO Elon Musk's increasingly controversial public persona has begun affecting sales, particularly in liberal leaning markets where Tesla previously dominated. "People know quality when they see it," Musk often states, but recent surveys suggest brand perception issues among key demographics.

Tesla's competitive advantages extend beyond vehicles. The company's Supercharger network remains the gold standard for EV charging infrastructure, while Autopilot and Full Self Driving capabilities lead autonomous vehicle development. Energy storage and solar panels provide additional revenue streams, though automotive sales remain the primary business.

Honda Motor Company

Honda Motor Company delivered 4.1 million vehicles globally in 2024, representing an 11.4% decline from the previous year. The Japanese manufacturer operates through two primary brands: Honda (mainstream vehicles known for reliability) and Acura (luxury division struggling for identity).

Honda's strength lies in engineering excellence and hybrid technology. The Accord remains America's best selling midsize sedan, while the CR-V competes directly with Toyota's RAV4 for crossover supremacy. The Civic continues as the compact car benchmark, and the Pilot defines three row SUV practicality.

In the United States, Honda's 2024 performance showed resilience with 1.29 million vehicles sold (up 11.1%), driven by strong CR-V and HR-V demand. The company gained market share across multiple segments, proving that reliable, fuel-efficient vehicles remain relevant despite electric vehicle enthusiasm.

Acura represents Honda's luxury challenge. With 132,367 units sold in 2024 (down 9.1%), the brand struggles against German luxury competitors and even Genesis. The TLX sedan and MDXvSUV offer Honda reliability at premium prices, but lack the emotional appeal of European alternatives.

Honda's electric future centers on practical efficiency rather than performance theater. The company commits to carbon neutrality by 2050 while maintaining hybrid offerings for customers not ready for full electrification. As one Honda engineer explained, “We build cars for real people, not just early adopters.”

Nissan Motor Company

Nissan Motor Company faces existential challenges despite pioneering electric vehicle technology. With 3.35 million vehicles sold globally in 2024 and a devastating net loss of ¥671 billion ($4.5 billion), the Japanese manufacturer exemplifies how quickly automotive fortunes can reverse.

Nissan's brand portfolio includes Nissan (mainstream vehicles) and Infiniti (luxury division). The Altima competes in America's shrinking sedan market, while the Rogue challenges Honda and Toyota in the crucial crossover segment. Infiniti sold just 58,070 vehicles in the US during 2024, reflecting luxury market struggles.

The company's challenges stem from strategic missteps rather than product quality. The Leaf pioneered affordable electric vehicles but fell behind Tesla's Model 3 in technology and desirability. The Ariya electric crossover shows promise but arrived years late to a crowded market.

New CEO Ivan Espinosa inherited a company requiring fundamental restructuring. Operating margins shrank to 0.6% in 2024, while competitors achieved 5 - 10% margins. The company's alliance with Renault adds complexity without clear benefits, and Chinese market share continues declining.

Nissan's future depends on electric vehicle execution and operational efficiency. The company possesses advanced battery technology and manufacturing capabilities but lacks the strategic clarity shown by Tesla or traditional competitors. As one analyst noted, “Nissan has the tools for success but needs leadership to deploy them effectively.”

BYD

BYD represents China's automotive emergence as a global force. With 4.2 million vehicles sold in 2024 and backing from Warren Buffett's Berkshire Hathaway, BYD has become the world's largest electric vehicle manufacturer, surpassing Tesla in pure electric vehicle sales.

The company's vertical integration extends from battery manufacturing to vehicle assembly, providing cost advantages that traditional automakers struggle to match. BYD controls lithium mining, battery production, semiconductor manufacturing, and vehicle assembly, a supply chain integration that enables rapid scaling and cost control.

BYD's 2024 performance demonstrates the power of focused electric vehicle strategy. The company sold over 514,000 vehicles in December 2024 alone, with the Seagull compact EV priced at $9,698 challenging global automotive economics. Models like the Song and Tang SUVs provide family transportation at prices that make Tesla look expensive.

The company's global expansion accelerates despite geopolitical tensions. BYD vehicles appear in European markets, Southeast Asia, and Latin America, while plans for North American manufacturing face regulatory hurdles. Warren Buffett's investment provided credibility, though Berkshire has reduced its stake below 5% after substantial gains.

BYD's challenge lies in brand perception outside China. While products offer excellent value and advanced technology, consumers in established markets often prefer familiar brands. The company's success domestically proves that automotive dominance isn't permanent, a lesson that established manufacturers are learning rapidly.

Geely Holding

Geely Holding achieved 3.34 million vehicle sales in 2024, representing a 22% increase and positioning the Chinese conglomerate as a global automotive force. The group's brand portfolio demonstrates how Chinese manufacturers acquire Western technology and heritage: Geely Auto, Volvo Cars, Polestar, Lotus, LYNK & CO, and Zeekr.

Volvo Cars remains the crown jewel, providing Swedish safety heritage and premium positioning. The XC90 and XC60 SUVs compete directly with German luxury brands, while the S90 sedan offers Scandinavian elegance. Polestar represents Volvo's electric performance division, though the brand struggles with identity and profitability.

Lotus brings British sports car heritage to the group, while Zeekr targets Chinese luxury EV buyers. This brand diversity enables market segmentation impossible for single brand manufacturers, though it also creates management complexity and potential internal competition.

Geely's 2024 financial performance shows the challenges of rapid expansion. Polestar, Zeekr, and Lotus reported combined losses of $2.2 billion, while Volvo and Geely Auto generated profits. The group's billionaire founder Li Shufu has initiated cost cutting measures to improve profitability across all brands.

The company's electric vehicle transition accelerates across all brands. Polestar positions as Tesla's performance rival, Zeekr offers Chinese luxury, and Volvo commits to electric only by 2030. This diversified approach hedges against market uncertainty while requiring massive capital investment.

Tata Motors

Tata Motors controls two of Britain's most prestigious automotive brands: Jaguar and Land Rover. The Indian conglomerate's ownership of these luxury marques represents one of automotive history's most successful international acquisitions.

Jaguar Land Rover reported €29.0 billion in revenue for 2024, with 401,301 vehicles delivered globally. The brands maintain distinct identities: Jaguar focuses on luxury sedans and sports cars, while Land Rover dominates premium SUVs with models like the Range Rover and Defender.

The luxury duo's 2024 performance showed resilience despite market challenges. Range Rover Sport sales drove profitability, while the Defender achieved record sales volumes. In India, JLR surpassed Audi to become the country's third largest luxury car brand, demonstrating emerging market potential.

Tata's stewardship has revitalized both brands through massive investment in design, technology, and manufacturing. The Range Rover Evoque created the luxury crossover segment, while the new Defender successfully modernized an icon. Jaguar faces greater challenges, with plans for electric-only transformation by 2025.

The company's electric transition centers on the I-PACE SUV and upcoming Range Rover Electric. Both brands possess the luxury positioning necessary for premium EV pricing, though execution remains challenging. As one JLR executive noted, “Luxury customers expect the best of everything, including electric powertrains.”

Ferrari and Lamborghini

Ferrari and Lamborghini represent automotive's ultimate luxury expressions, where engineering meets art and pricing defies conventional logic. These Italian superstars demonstrate how brand heritage and exclusivity create value that transcends transportation.

Ferrari achieved €6.67 billion in revenue for 2024, with net profits of €1.5 billion, margins that would make technology companies envious. The brand sold approximately 15,000 vehicles globally, with each car averaging over €400,000. Limited production creates waiting lists that enhance desirability while maximizing profitability.

The Ferrari 296 GTB and SF90 Stradale showcase hybrid supercar technology, while the Purosangue SUV proves that even Ferrari cannot ignore market trends. The company's Formula 1 success directly supports brand value, with racing victories translating to increased civilian model demand.

Lamborghini reported record 2024 performance with €3.35 billion in revenue (up 16.2%) and 904 million in operating income. The brand delivered approximately 10,000 vehicles globally, with models like the Huracán and Aventador defining supercar aesthetics and performance.

Lamborghini's approach differs from Ferrari's exclusivity. The brand embraces bold design and accessibility within the supercar segment, attracting younger customers who view the Raging Bull as more approachable than Ferrari's Prancing Horse. The Urus SUV represents 60% of sales, proving that even supercar manufacturers need practical products.

Both brands face electric futures with different strategies. Ferrari commits to maintaining V12 engines alongside electric models, while Lamborghini plans electric only by 2030. The challenge lies in preserving emotional appeal while meeting emissions regulations. As one Ferrari engineer explained, “Electric motors are faster, but V12 engines have souls.”

These notable brands demonstrate that automotive success takes many forms, from BMW's focused luxury to Tesla's electric revolution, from BYD's Chinese efficiency to Ferrari's Italian artistry. Each company represents different approaches to similar challenges: changing consumer preferences, electric vehicle transitions, and global market competition. Their diverse strategies and varying fortunes illustrate that the automotive industry's future belongs not to a single approach, but to companies that understand their unique strengths and execute them flawlessly.

The industry's consolidation continues as development costs soar and regulations tighten. Smaller brands either join larger groups or risk extinction. Technology partnerships blur competitive lines as former rivals share batteries, software, and manufacturing.

What remains constant is human attachment to automotive brands. People don't merely buy transportation, they buy identity, aspiration, and belonging. Whether it's a Toyota's reliability, a Porsche's performance, or a Jeep's capability, these corporate giants succeed by understanding that cars are never purely rational purchases.

As one industry analyst noted, "The car business is about dreams delivered at scale." These automotive empires, with their complex subsidiaries, competing brands, and sometimes contradictory strategies, continue delivering those dreams to millions of customers worldwide, one vehicle at a time.

Comments (0)

Please login to join the discussion

Be the first to comment on this article!

Share your thoughts and start the discussion